Input Service Distributor (ISD) is an office of the supplier of goods or services or both which receives tax invoices issued under section 31 towards the receipt of input services and issues a prescribed document for the purposes of distributing the credit of Central tax, State tax, Integrated tax or Union territory tax paid on the said services, to a supplier of taxable goods or services or both having the same permanent Account Number as that of the said office”. Section 2 (61) of the CGST Act, 2017

ISD is a facility given under GST laws to the dealers who have multistate presence and who have centralized procurement of services which are utilized by its establishments (having same PAN as that of head office) located in various states. Facility of ISD is available only in respect of services and not in respect of goods.

Example:

A Ltd. has HO in Mumbai and branches / establishments in Ahmedabad, Delhi & Kolkata (all having same PAN). HO receivers Invoice for inward supply of service (wherein GST is charged). Such service is utilized by all or any of the above branches. Since invoice is raised to HO, Input Tax Credit (ITC) per se cannot be claimed by branches utilizing the said services. Mechanism of ISD (under GST laws) allows HO to distribute credit of ITC among the branches (which utilize the said services) by following prescribed method. Provisions & manner of distributing credit through ISD mechanism

1. ISD shall obtain separate registration as ISD. Such registration is different from normal registration u/s. 22.

2. Credit can be distributed only of eligible amount considering provisions of block – credit u/s.17(5) and through a document (i.e. Invoice) in terms of Rule 54.

3. Credit of service attributable to a particular recipient shall be distributed only to that recipient (in above example, if service was provided only to Ahmedabad branch & invoice raised to HO, HO shall distribute credit only to Ahmedabad branch).

4. Credit of tax paid on input service attributable to more than one recipient of credit or to all recipient of credit, shall be distributed among such recipient’s pro rata on the basis of turnover in a state / union territory of such recipient during the “relevant period”, to the aggregate of the turnover of all such recipients and which are operational in the current year, during the said “relevant period.”

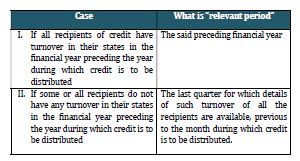

The term “relevant period” is defined very peculiarly:

5. Turnover shall also include turnover of goods not taxable under the Act.

6. Credit qualifying for distribution is to be calculated using following formula given in Rule 39(1) (d):

C1= (t1 / T) x C

Where,

C = amount of credit to be distributed.

t1 = turnover of recipient R1 during relevant period.

T = the aggregate of the turnover, during the relevant period, of all recipients to whom the input service is attributable

C1 = the input tax credit that is required to be distributed to recipient R1 (whether registered or not).

The above formula should be applied for every type of tax viz., Central tax, State tax, Union Territory tax & Integrated tax and should be distributed as under:

From accounting perspective, an ISD may be required to maintain account of CGST + SGST credit Statewise.

It may be noted that Rule 39 mandates distribution of credit to all the recipients to whom credit is attributable, although such units may not be registered under the Act.

At the same time, recipient to whom credit is attributable should be registered under the Act, to be eligible to claim credit so distributed to it.

7. Invoice by ISD: ISD shall issue Invoice for distributing credit clearly indicating that Invoice is issued only for distributing credit.

8. Debit notes / Credit notes: On receiving debit notes / credit notes, ISD shall accordingly issue debit notes / credit notes to the original recipients.

9. Filing of return by ISD: ISD is required to file monthly return in form GSTR – 6, within 13 days of following month.

Conclusion:

ISD, a mechanism to distribute credit among various recipients, is cumbersome e.g. to distribute credit in the same month, filing return in 13 days, complicated computation etc. Hence wherever possible, it is advisable to raise invoice directly on the concerned unit receiving service.